You’ve spent weeks researching the perfect car. You’ve test-driven it. You’ve even agreed on a monthly payment. Now comes the part everyone dreads: The Finance Office.

This is where the "deal" you shook hands on often falls apart.

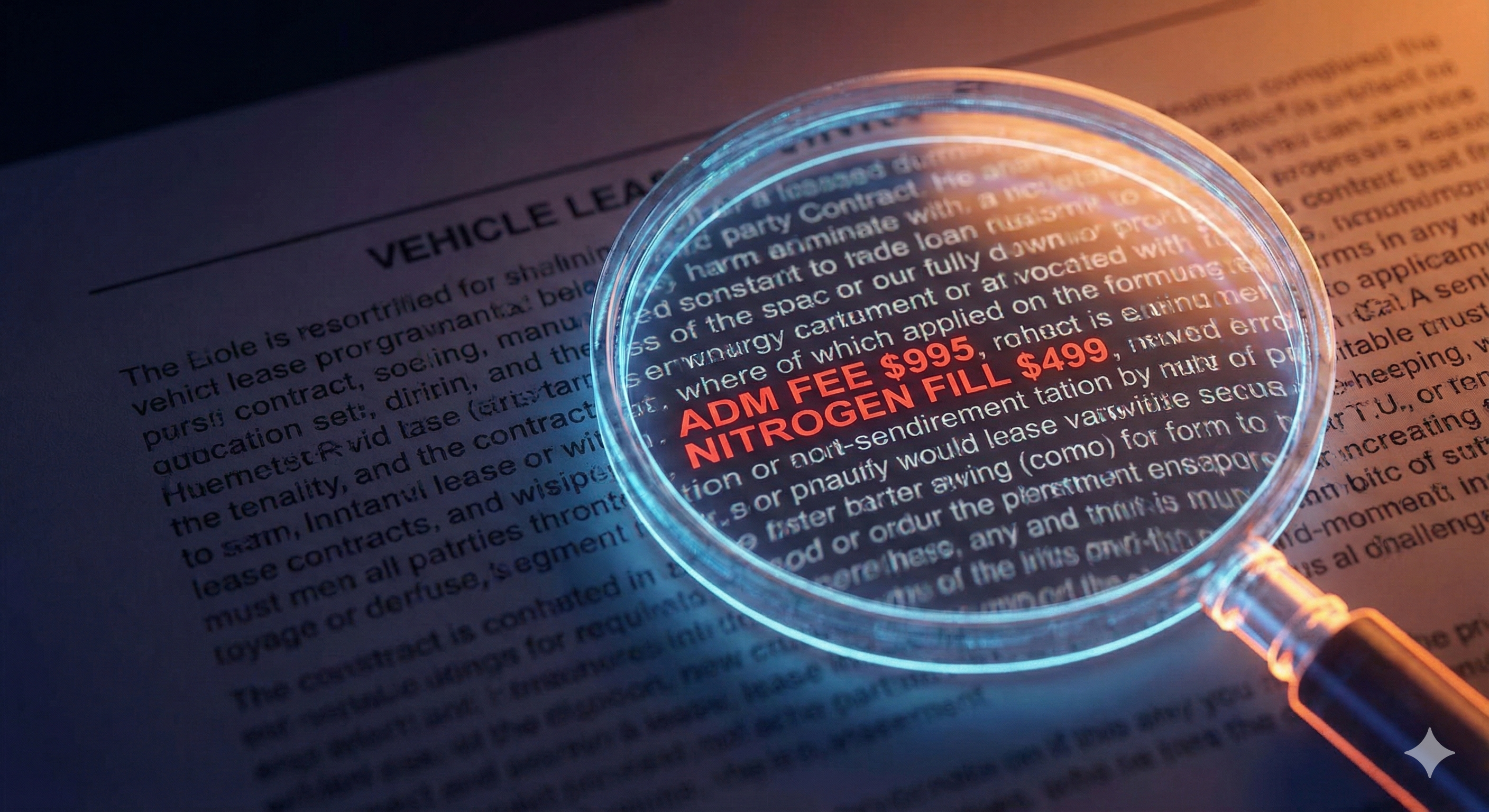

Buried in the fine print of that long, yellow contract are often hundreds—sometimes thousands—of dollars in extra charges. Dealers count on two things: your exhaustion and your confusion. They hope you'll just sign to get it over with.

Don't let them win. Here is the "Dirty Dozen"—the 12 most common hidden fees to watch for, and exactly how to handle them.

The "Bogus" Fees (Refuse These Immediately)

These fees offer you zero value. They are pure profit generators for the dealership.

1. Nitrogen Fill

- The Cost: $99 – $499

- The Pitch: "It keeps tire pressure stable better than regular air."

- The Reality: The air we breathe is already 78% nitrogen. Paying $200 for green valve caps is one of the biggest scams in the industry.

- Verdict: REFUSE. If they say it's "already on the car," tell them you won't pay for it.

2. VIN Etching

- The Cost: $199 – $399

- The Pitch: "We etch the VIN onto the windows so thieves won't steal the car."

- The Reality: You can buy a DIY kit on Amazon for $20. It rarely lowers insurance rates enough to justify the cost.

- Verdict: REFUSE.

3. Dealer Prep / Reconditioning Fee

- The Cost: $500 – $1,000+

- The Pitch: "This covers washing, vacuuming, and checking the fluids."

- The Reality: Getting the car ready for sale is the "cost of doing business." You shouldn't pay a salary to the person washing the car.

- Verdict: REFUSE. Ask them why this isn't included in the sticker price.

4. Advertising Fees

- The Cost: $300 – $1,000

- The Pitch: "We have to pay the manufacturer for those TV commercials."

- The Reality: True, they do. But that is an operational cost that should be built into the price of the car, not tacked on as a line item at the end.

- Verdict: NEGOTIATE. Tell them you are paying the price of the car, not their marketing budget.

5. Market Adjustment (or "ADM")

- The Cost: $1,000 – $10,000+

- The Pitch: "This is a hot car. Supply and demand."

- The Reality: Pure greed. This is a markup simply because they think they can get away with it.

- Verdict: WALK AWAY. Unless it is a rare Ferrari, find another dealer who doesn't charge ADM.

The "Overpriced" Products (Buy Elsewhere)

These are real products, but the dealership marks them up by 200% or more.

6. GAP Insurance

- The Cost: $700 – $1,200 at the dealer.

- The Reality: GAP is essential if you are putting little money down. However, your own auto insurance company or credit union usually sells it for $40–$100 a year.

- Verdict: BUY ELSEWHERE. Get it from your insurer.

7. Extended Warranties

- The Cost: $2,000 – $4,000

- The Reality: Dealer warranties are often "third-party" contracts with high deductibles and strict rules.

- Verdict: SKIP FOR NOW. You can buy an extended warranty anytime before the factory warranty expires. Shop around first.

8. Paint & Fabric Protection

- The Cost: $400 – $1,000

- The Reality: It’s often just a spray-on wax or Scotchgard applied by a porter in the back.

- Verdict: REFUSE. Buy a $20 bottle of protectant and do it yourself.

The "Questionable" Admin Fees (Watch Closely)

9. Documentation (Doc) Fee

- The Cost: $85 – $900 (Depending on the state).

- The Reality: This pays the clerks to file the paperwork. Some states (like NY or CA) cap this fee by law (e.g., $175). Others (like FL or VA) have no limit.

- Verdict: VERIFY. If it seems high, check your state’s average. If it’s uncapped, ask them to lower the price of the car to offset it.

10. Electronic Filing Fee

- The Cost: $20 – $50

- The Reality: Often a duplicate of the Doc Fee. If you are paying a Doc Fee, why are you paying another fee to file digitally?

- Verdict: CHALLENGE IT. Ask if this is legally required or just a profit center.

11. Destination Charge (On Used Cars)

- The Cost: $900 – $1,600

- The Reality: On a New car, this is legit (it pays to ship the car from the factory). On a Used car, the first owner already paid this. You should never pay destination on a used vehicle.

- Verdict: REFUSE on Used Cars.

12. Credit Life / Disability Insurance

- The Cost: Varies.

- The Pitch: "If you die, this pays off the car."

- The Reality: It is expensive coverage with very low payout rates. A standard Term Life insurance policy is much better and cheaper.

- Verdict: REFUSE.

How to Spot Them Before You Sign

Trying to memorize this list while a finance manager stares at you is stressful. They often hide these fees using acronyms or bundle them into the "Total Cash Price" so you don't notice.

You don't need to be a lawyer to fight back. You just need SignSpark.

Before you pick up the pen, pick up your phone.

- Scan: Take a photo of the contract or purchase order.

- Analyze: SignSpark’s AI reads the fine print instantly.

- Detect: We flag the "Dirty Dozen" automatically and tell you exactly what to say to remove them.

Don't let a $499 nitrogen fee ruin a great deal.

Stop guessing. Start saving.

Upload your contract now for an instant fairness check.